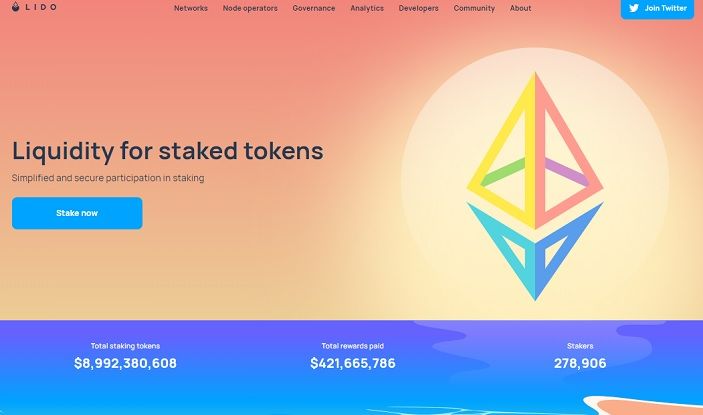

Lido Finance: Unlocking Liquid Staking for the Ethereum Ecosystem

As Ethereum continues its transition to Ethereum 2.0 and the broader DeFi ecosystem matures, new innovations are emerging to solve longstanding challenges. One such innovation is Lido Finance, a decentralized liquid staking protocol that is revolutionizing how users stake their ETH and other assets while maintaining liquidity.

In this blog post, we will explore what Lido Finance is, how it works, the advantages it brings to the crypto community, some of the risks involved, and its potential future impact on the blockchain ecosystem.

What Is Lido Finance?

Lido Finance is a decentralized protocol that offers liquid staking for Ethereum 2.0 and other proof-of-stake (PoS) blockchains. Launched in December 2020, Lido allows users to stake their ETH without locking it up or losing liquidity, which has traditionally been a major barrier to entry for many investors.

When users stake their ETH through Lido, they receive a liquid token called stETH in return. This token represents their staked ETH plus accrued staking rewards and can be freely traded, used as collateral in DeFi protocols, or transferred, unlike locked ETH staked directly in Ethereum 2.0.

Lido essentially solves the illiquidity problem in staking — letting users earn staking rewards without sacrificing the ability to use their assets elsewhere.

How Does Lido Work?

To understand Lido, it helps to grasp the basics of Ethereum staking:

- Ethereum 2.0 staking requires locking up ETH for an extended period (until the full network upgrade is complete).

- Direct staking requires 32 ETH minimum to run a validator node.

- Staked ETH is illiquid, meaning it cannot be moved, sold, or used until withdrawal is enabled in a future upgrade.

Lido abstracts away these complexities. Here’s the step-by-step process:

- Users deposit any amount of ETH into Lido’s smart contract.

- Lido pools the ETH and stakes it on the Ethereum 2.0 Beacon Chain through professional validator operators.

- Users receive stETH tokens representing their share of staked ETH plus staking rewards.

- stETH tokens can be freely traded, used as collateral, or held.

- As validators earn rewards, the value of stETH increases relative to ETH.

- When withdrawals on Ethereum 2.0 are enabled (post-merge upgrade), users can redeem stETH for their original ETH plus rewards.

Lido works similarly on other chains, including Terra, Solana, and Kusama, adapting to each network’s staking mechanism.

Advantages of Lido Finance

1. Liquidity While Staking

One of Lido’s main selling points is liquid staking. Unlike traditional staking, where assets are locked and inaccessible, Lido’s stETH tokens let users keep liquidity. This unlocks multiple use cases:

- Trade stETH on exchanges.

- Use stETH as collateral in lending protocols like Aave or Compound.

- Participate in yield farming with stETH.

This flexibility encourages more people to stake their ETH and supports DeFi composability.

2. Lower Entry Barrier

Ethereum’s 32 ETH minimum is prohibitive for many retail investors. Lido allows staking with any amount of ETH, democratizing access to staking rewards.

3. Professional Validator Operations

Lido delegates staking to vetted professional node operators, ensuring high uptime and security without users needing to manage infrastructure themselves.

4. Decentralized Governance

Lido’s DAO governs the protocol, including validator selection and fee structures, providing a community-driven approach that aligns incentives.

5. Earning Staking Rewards

Users earn rewards from the Ethereum 2.0 network, which can range around 4-6% APY depending on network conditions. This provides a passive income stream on idle ETH.

Challenges and Risks

While Lido Finance brings many benefits, it’s not without risks and challenges:

1. Smart Contract Risk

As a DeFi protocol, Lido relies on smart contracts. Any bugs or exploits could lead to loss of funds. Although Lido has undergone audits, smart contract risk is never zero.

2. Centralization Concerns

Currently, Lido controls a significant portion of staked ETH on Ethereum 2.0 (over 30% as of mid-2025). This concentration raises concerns about potential centralization, which conflicts with Ethereum’s decentralized ethos.

3. Price Divergence

The value of stETH is designed to track ETH plus staking rewards, but market demand and liquidity issues can cause stETH to trade at a discount or premium to ETH. This divergence introduces some price risk for holders.

4. Regulatory Risks

Liquid staking protocols exist in a regulatory gray area. Future regulations around securities or financial products could impact Lido’s operations.

The Future of Lido and Liquid Staking

Lido Finance’s impact on Ethereum staking and the DeFi ecosystem is significant and growing. Here are some trends and future possibilities:

1. Multi-Chain Expansion

Lido is expanding liquid staking to other PoS blockchains beyond Ethereum, such as Solana and Polkadot’s Kusama network, broadening its user base.

2. Layer 2 and Cross-Chain Solutions

With Ethereum scaling solutions and cross-chain bridges developing, liquid staking tokens like stETH may become more interoperable, enabling richer DeFi experiences.

3. Improved Decentralization

Lido is actively working to decentralize validator operators and governance to reduce centralization risks and align with Web3 ideals.

4. Staking as a DeFi Primitive

Liquid staking tokens are becoming foundational assets in DeFi, powering new financial products, yield strategies, and derivatives.

Conclusion

Lido Finance is a pivotal player in the evolution of Ethereum 2.0 and liquid staking. By addressing liquidity, accessibility, and ease of staking, it unlocks new possibilities for ETH holders and the broader DeFi ecosystem.

Made in Typedream